В каталоге магазина в Москве представлен большой выбор одежды и снаряжения. [url=http://specodegdaoptom.ru/]магазин спецодежды рядом со мной[/url] Смотрите по ссылке -…

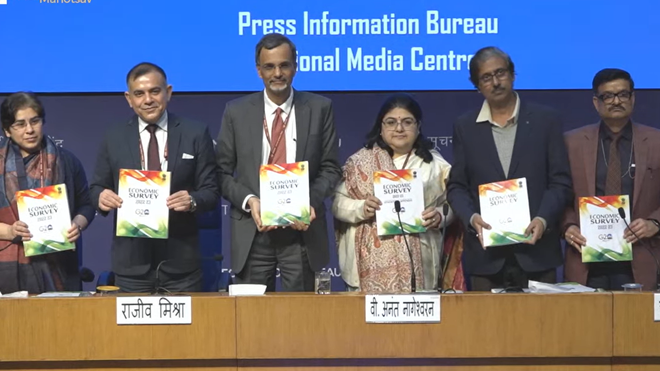

Number Theory: What does the Economic Survey tell us about the Budget?

The first advanced estimate of GDP, which was released by the National Statistical Office (NSO) earlier this month, put the GDP growth in 2022-23 at 15.4%.

What does the Economic Survey 2022-23 tabled in Parliament on January 31 tell us about the Union Budget? Here are four things that stand out. Revenue growth may slow in 2023-24 with lower nominal GDP growth

The survey has projected a modest growth rate of 11% for 2023-24. As per the survey, real GDP growth is expected to be in the range of 6-6.8%. The first advanced estimate of GDP, which was released by the National Statistical Office (NSO) earlier this month, put the GDP growth in 2022-23 at 15.4%. This means that nominal growth is expected to decelerate significantly in the next financial year. Unless there is a significant increase in tax buoyancy – the change in tax collection per unit of GDP – growth in tax revenue in 2023-24 is likely to be lower than in 2022-23. To be sure, the shortfall in nominal growth is more due to a decline in inflation rather than a decline in real GDP growth, which is likely to hit 6.5% next year as per the survey’s baseline projection.

Government likely to meet its fiscal deficit target for 2022-23 and further consolidate it in FY24

The fiscal deficit for 2022-23 was estimated at 6.4% of GDP in last year’s budget. While the Revised Estimates (RE) for the fiscal deficit will be presented in tomorrow’s Budget (and even the RE numbers are liable to change) the survey gives an indication that the government may not stick to its fiscal deficit target for 2022-23. would be able to obtain. The survey suggests that this has been due to a sharp increase in direct taxes and the Goods and Services Tax (GST) and limited revenue expenditure, “which should ensure the entire expenditure of the capex budget within the budgeted fiscal deficit”.

The focus will continue on the disinvestment and asset monetization program

One area where the budget has fallen far short of its targets in the recent past is disinvestment. For example, the Budget Estimate (BE) for disinvestment receipts in the Budget for 2021-22 was Rs 1.75 lakh crore, which was reduced to Rs 78,000 crore in the Revised Estimates for 2021-22. The budget estimates for 2022-23 put the disinvestment proceeds at ₹65,000 crore. While the RE number for 2022-23 is likely to be lower than this number, the survey suggests that the government’s disinvestment push is likely to continue. The survey, in fact, has linked the disinvestment and asset monetization program of the government with a capex tilt in government spending. The survey said that this was part of a strategic package aimed at boosting private investment in the economic landscape by giving up non-strategic PSEs (disinvestment) and idling public sector assets.