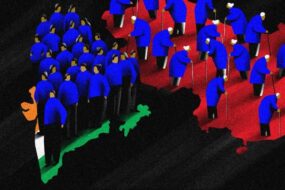

SVB failure and it’s impact on Indian startups : Indian start-ups may have deposits worth of one billion Dollar with the failed bank . This was stated by deputy IT minister . SVB had 209 billion Dollars at the end of 2022. It is a good opportunity for Indian banks to lend the start-up ecosystem in India. Indian banks can offer deposit backed loans to start- ups . India has large number of start-ups with many claiming huge valuations by foreign investors. Signature bank also failed because of it’s crypto currency bet turned sour .

2. Copilot : It is launched by microsoft and allows the user to generate content on microsoft 365 application . It allows AI technology to the users during the ‘ future of work ‘ event it has launched . It amplifies work space productivity tools . Copilot uses microsoft graph , Microsoft 365 apps and larger language models and offer solutions for bussiness . It will improve creativity and unlock productivity. It will help in applications such has Excel , word , power point , teams and out look extra . With copilot, customers can be more creative in word ,more analytical in Excel , more expressive in out look and more collaborative in teams . Microsoft is experimenting copilot with 20 customers including 8 fortune 500 companies .

3. First Republic Bank collapse : After silicon valley bank and Signature bank failure , First republic bank is planning a sale after its share price fell 60% . The bank got 70 billion Dollar emergency loan from JP Morgan Chase and the Federal Reserve .First republic helps start- ups similar to Silicon valley bank which failed earlier . Apart from bank of America ,City group , JP Morgan Chase which put 5 billion dollar in uninsured deposits of First Republic, Morgan Stanley and Gold man Sachs will put 2.5 billion Dollar each . It reflects the confidence in the US banking system . Following this First Republic bank gained 9.98% in share market . US treasury Secretary said American citizen can have confidence in banks in America.